Do you want to increase Chime spending or Spotme limit or want to know how much can you withdraw via chime from an ATM or how much is the Chime daily deposit limit?

If these are your questions, you have landed on the right page. In this post, we have discussed all you need to know about the Chime spending, withdrawing, and deposit limit.

So, let’s get started.

Do you have a lot of money sitting in your Chime account, but you are not able to spend much and get payment declined errors?

If you have experienced such issues that, don’t forget there is a pre-decided limit for everything on Chime. So, if you are a regular user of Chime or just started using it, you must know the transferring and spending limits of Chime.

Chime Daily withdrawal limit / Chime ATM withdrawal limit

Chime withdrawal limits depend upon the method of transaction, but there is no limit to the number of times you can withdraw money using the Chime visa debit card. However, there is a limit on the amount of money you can withdraw each day.

Below is the Chime withdrawal limits depending on the method of withdrawal:

| Chime Card Transaction Type |

Frequency and/or Dollar Limit |

| ATM Withdrawal | $500 per day, no limit to the number of times per day |

| Cash Back at Point-of-Sale (POS) | No limit to the number of times per day up to $500.00 per day |

| Over The Counter (OTC) Withdrawals | No limit to the number of times per day up to $500.00 per day |

| Card Purchases (Signature & PIN) | No limit to the number of times per day up to $2,500.00 per day |

SEE ALSO: Can I overdraft my Chime Card at Atm or for Gas?

So, as you can see in the table above, Chime max ATM withdrawal daily limit is $500. However, there is no limit on the number of times you can withdraw money from an ATM using your Chime card, but the total amount should be less the $500 in a day.

Note:: ATM owner-operators, merchants, and participating banks may impose their own lower limits on cash withdrawals.

Also, Limits reset Midnight Mountain Time.

Chime Deposit limit / Chime Transfer Limit

Bank (ACH) transfers to the Spending Account that are initiated with the Chime app or website are limited to:

- $10,000 per calendar day

- $25,000 per calendar month

- No limit to the number of times per day

Cash loads have:

- A maximum of three (3) per day

- A limit of $1,000 per load per day

- A maximum of $10,000 per calendar month

Chime does not impose a limit on bank transfers (ACH transfers) that are initiated from an external account. There is no limit to the number of times per day, nor is there a maximum dollar limit. However, external banks may impose their own limits and fees.

SEE ALSO: How to check Chime Pending Deposits (2021)

Increase Chime Spending Limit

Unfortunately, there isn’t a way to increase the Chime spending limit. Spending limits for Chime users are fixed and pre-decided and cannot be increased.

Some P2P money transferring apps such as Cash App, Venmo, etc. allows users to increase their limit upon identity verifications, but there is no such feature in Chime.

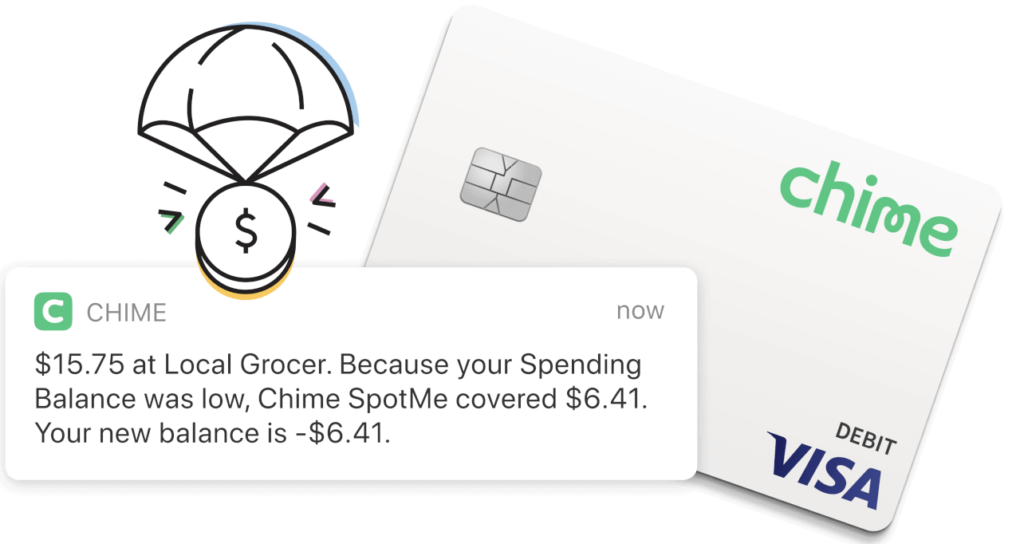

Well, if you use Chime Spotme feature and its limit is $20, it might be increased up to $200 based upon your account history, spending and deposit frequency.

How to increase Chime SpotMe limit

Chime Spotme limit cannot be increased manually, the default Chime Spotme limit is $20 for new users. However, based on your Account history, direct deposit frequency and amount, spending activity, and other risk-based factors, Chime can increase your limit up to $200.

So, to increase the Chime Spotme limit maintain a good balance, and keep receiving direct deposits consistently in your Chime spending account, and your limit will be increased automatically.

If you feel, your spending and depositing frequency in Chime account is good and consistent, and still, your Spotme limit is $20, then you may contact Chime support and request them to increase your limit.

To get in touch with Chime support, you can use one of the following methods.

- Email: [email protected].

- Phone: 844-244-6363.

SEE ALSO: Why is my Chime Spot Me not Working (6 Reasons)

Final Words

Chime is a financial technology company owned by Bancorp bank. It provides fee-free banking services to users.

The best part of using Chime account is that user can receive their direct deposits 2 days early. Moreover, Chime also allows user to overdraft their account without charging any fee like other services and banks that can charge up to $34 for over drafting the account.

Well, like most bank and services, Chime does have a spending and depositing limit. The amount of money one can send, receive and withdraw in Chime is pre-decided. And unfortunately, these limits (detailed above) cannot be increased in any way.

However, if you use Chime Spotme feature and your limit is $20, it can be increased up to $20, but it is totally dependent on how well you maintain your account as discussed above in the post.

So, that’s all for now. I hope you were able to know all the details about the Chime spending, transferring, depositing, and withdrawing limits after reading this post. For more guides like this, you can visit our dedicated Chime page, or follow a few related posts below.

Further Reading:

How to link Cash App to Chime & Transfer Money

How to Unsuspend my Chime account (Reopen Now)

How to check Chime balance & Chime card balance

Ankit Kumar is an Engineer by profession and a blogger by passion. Over the last several years, he has written tons of articles, solving queries on Quora. He also has years of experience in investing in Cryptocurrencies, Funds, and Stocks.