Why is Chase holding my check for 10 days?

Is there a hold on your Chase check deposit, and you are wondering why?

If Chase has put a hold on your check, and you aren’t aware why then you have been on the right page. Here in this post, we have discussed the reasons Chase might put a hold on your check, how long it could last, and what you can do to avoid a check hold in the future.

So, let’s get started.

It’s a great feeling to receive a check and deposit it in your bank account. But, it becomes irritating when the funds do not get deposited in your account, and you see that your bank has put a hold on the check.

Well, most banks, including Chase, clear the checks within 1-2 business days, but they have the authority to hold the check for longer, which can be due to several reasons, as discussed below.

Why is my Check on hold (CHASE)

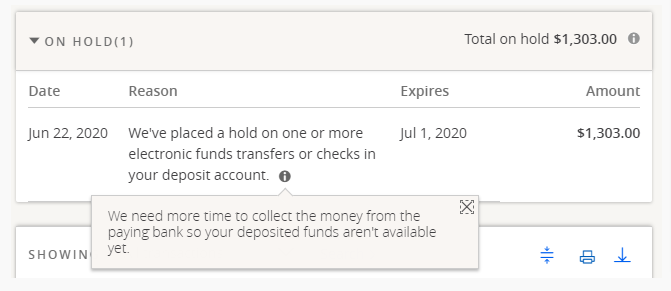

Chase might put a hold on your check due to several reasons, such as the check payer doesn’t have sufficient funds to clear the check, you are a new chase customer, the check deposit amount is large, you have a history of frequent overdrafts, or the check was returned unpaid before.

If your check has been put on hold by Chase, you don’t need to panic. There might still be $100-$200 of the check funds available to you, and the remaining will be deposited later.

You would like to know in detail the reasons why would Chase hold your check for longer:

1. Check payer doesn’t have sufficient funds

The first and foremost reason Chase has put your check on hold is that the check payer does not have enough funds in their banks to clear the check.

If this is the case, your check will be on hold till the bank or might get rejected.

2. You are a new customer

Another reason Chase has put your check on hold could be that you are a new Chase customer.

If you have recently opened a new Chase account, it is likely to be the reason your check is on hold.

Banks usually tend to hold the checks of the new customers longer than with whom they have a good and long-term relationship.

If you have been a Chase customer for years, and it’s not your first time, and you have been depositing checks in your account for years, then there is another issue why your check is on hold.

For example:

Person “A ” ( < 1 year with a balance of $200 in checking) or Person “B” with ($10,000 in checking and 15 years history). A gets a 5-day hold and B get access to the money.

3. Check amount is large

If the amount of the check you are depositing is very large, it could be the reason your check is on hold and taking longer than usual to get deposited in your account.

Checks worth large amounts are likely to be on hold, especially those in excess of the total current value of your account.

4. Frequent overdrafts

If you overdraft your Chase account frequently and do not pay it on time, then this could be the reason Chase is holding your check to make sure that the check is first cleared before the bank releases the funds to your account.

5. Check is from another bank

Moving on, another reason why Chase is holding your check for longer than usual could be that the check is from another bank.

The checks from the same banks are cleared within the same business days, while other banks’ checks might take longer.

In this case, Chase might give you access to $200 when you deposit the check, while the remaining amount can take longer to get deposited in your account.

6. Checks previously returned unpaid

If you are trying to deposit a check that was returned unpaid previously once or multiple times, then it is likely that Chase wants to validate the check before depositing the fund to your account.

Final Words

Chase is one of the largest American banks that offers a robust menu of features, services, and products. It has over 4,700 branches and 16,000 ATMs.

It offers auto loans, mortgages, the widest selection of credit cards. Its website and mobile banking app offer all the features that any online-only bank may feature.

You can use the Chase mobile check deposit feature to deposit your check with your smartphone from anywhere, without visiting the bank’s branch or an ATM.

Sometimes your Chase might put a hold on the check you deposited, which could be due to several reasons discussed above in the post.

So, that’s all for now, folks. After reading this post, we hope you were able to know why Chase may put a hold on your check.

For more posts on Chase, you can visit our Chase section or follow a few related posts below.

Further Reading

[10 Ways to Fix] Chase Mobile Deposit Not Working

(5 Reasons) Chase closed my credit card

[13 Reasons] Chase Debit Card Not Working

How to fix Chase digital wallet not working

[Fix] Why is Chase Refer-a-Friend not working

Ankit Kumar is an Engineer by profession and a blogger by passion. Over the last several years, he has written tons of articles, solving queries on Quora. He also has years of experience in investing in Cryptocurrencies, Funds, and Stocks.