Are you wondering if you can use Sezzle at Target store?

Do you want assistance with using the Sezzle virtual card at Target?

Well, if you are one of those looking for answers to these questions, this is the right web page.

Here, we have provided answers to all of your questions along with some additional details.

So, without further ado, let us dive right into the details.

Can you use Sezzle at Target

Yes, you can use Sezzle at Target using Sezzle virtual card. Sezzle can be used to finance the purchase at online Target site as well as at physical stores. Target is one of the merchants which offers BNPL (buy now, pay later) services by Sezzle and Affirm.

To use Sezzle at Target, you will be required to create a unique virtual card and add it to your Apple Pay or Google Pay and use it like any other debit card.

Need more details on the procedure? You will be glad to know that we have provided a detailed guide on how you can use Sezzle at Target.

How to use Sezzle at Target

Before proceeding with our step-by-step guide, make sure you have an active Apple Pay or Google Pay account. Sezzle will ask you to add the virtual card to either Apple Pay or Google Pay in order to make transactions.

So, if you do not have a Google Pay or Apple Pay account, we will suggest creating your account before proceeding with the guide.

Step 1 – Download Sezzle app

First things first, download the Sezzle mobile app on your mobile device. The app is available for free for both the Android and iOS platforms. Go to the respective app store and download the app.

If you already have the app downloaded on your device, make sure your device is running the latest version of the app to avoid any inconvenience caused by app bugs.

Also, before you ask, we would like to make it clear that you cannot create a virtual card on your PC. That’s why use your mobile device when you proceed with the guide.

Step 2 – Select ‘Target’ from the options

After you download the app, open it once.

On the home screen, you will see the list of participating merchants on the platform. Here, select the ‘Target’ store from the list to continue.

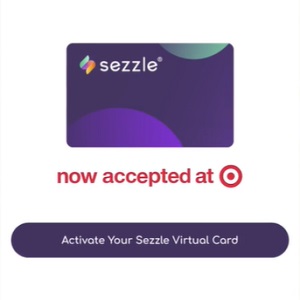

Step 3 – Activate Sezzle Virtual Card

After selecting Target from the list of stores, you will be directed to a new page.

Here, you will need to choose the ‘Select your Sezzle Virtual Card’ button and proceed with the next step.

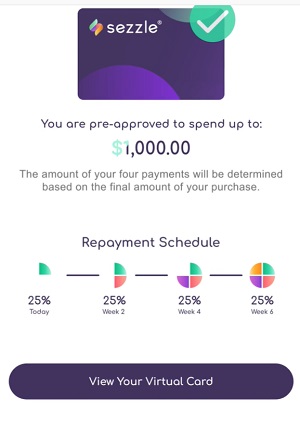

Step 4 – Check virtual card details

You will again find yourself on a new page. Here, select the ‘View your Virtual Card’ button to continue.

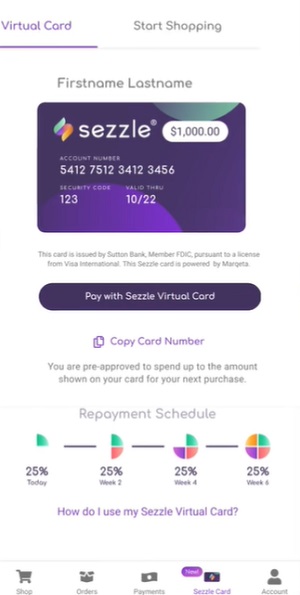

A new page will show you the details like payment split patterns and even your purchase limit. For instance, in the screenshot attached below, you can see the allowed limit is $1000.

FYI, if you are a new user, the company won’t approve a $1000. It takes time to build trust.

To know more, you can read our dedicated post on – How to increase Sezzle limit.

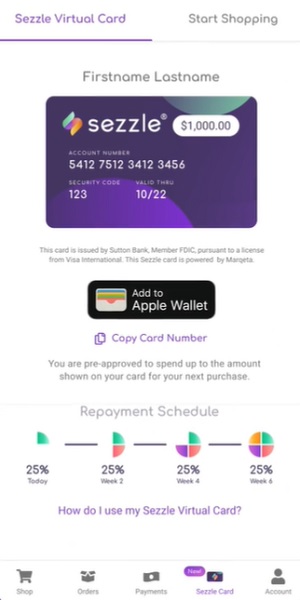

Step 5 – Add your virtual card to Apple Pay

As you already know, Sezzle uses third-party digital wallets like Apple Pay to help users pay with a virtual card.

That’s why, for the next step, you will be required to select ‘Add to Apple Pay’ to pay with a virtual card using Apple Pay.

Step 6 – Select your Sezzle card

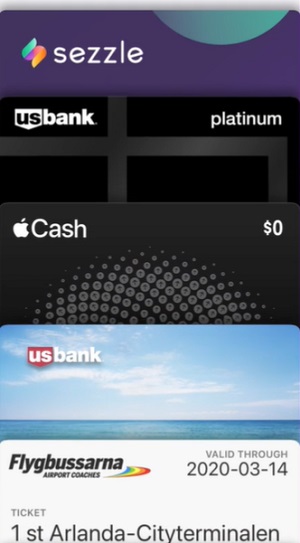

On adding your virtual card to Apple Pay, you will again see a number of cards on the screen. Select the Sezzle virtual card to continue.

Step 7 – Get the card details

Now that you have added your card to Apple Pay, your virtual card is now ready to be used as a payment method.

You can now access your Sezzle Virtual Card details by selecting the ‘Pay with Sezzle Virtual Card’ option.

A virtual Sezzle card will appear on the screen with card details.

Step 8a – Place your order on Target app

Now, if you are trying to use Sezzle at Target’s online store, you will first need to go to Target.com and select the products you want to buy.

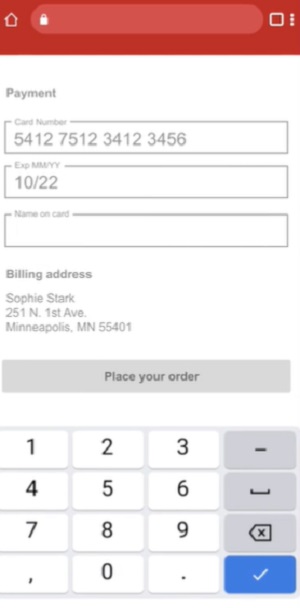

Submit the required details and proceed to the checkout page. On the checkout page, you will be required to add card details like card number, expiry date, and name on the card, along with the security code.

And that’s it.

If you have done everything right, you will be able to finance your purchase at Target.com. If you are facing issues with the final payment, you must check if you are requesting a purchase within your Sezzle spending limit.

Step 8b – Pay at Target store

In case you want to buy products from the Target store, you can easily use the Sezzle virtual card to pay. You first need to activate your virtual card. The procedure to create the virtual card is the same.

And right after activating your Sezzle virtual card, you will be able to pay using it.

Sezzle uses third-party digital wallets – Apple Pay and Google Pay to make the payment. Simply tap your mobile device to pay. The same way you use your Apple Pay to make the payment.

And you are done.

If you have done everything as discussed, Sezzle will finance your purchase, and you will be able to pay back the borrowed amount in four easy installments.

Step 9 – Receive confirmation

On using Sezzle at Target successfully, you will receive a confirmation as an in-app notification as well as on your registered email. And there, you will be able to see more details like the installment amount as well as the schedule.

And it’s done.

SEE ALSO: How to increase Sezzle limit

Final Words

Ladies and gentlemen, let us wrap this post now.

Here, in this post, we have first discussed if Sezzle can be used at the Target store. And later, we provided our step-by-step guide on how to Sezzle at Target. The guide includes steps for using Sezzle at both online and offline store.

If you have any queries regarding the steps involved, do let us know in the comments section below.

Further Reading:

(Guide) Can you buy gift cards with Sezzle

How to delete Sezzle account & close it properly

(8 Reasons) Sezzle Virtual Card Not Working

Ankit Kumar is an Engineer by profession and a blogger by passion. Over the last several years, he has written tons of articles, solving queries on Quora. He also has years of experience in investing in Cryptocurrencies, Funds, and Stocks.