Why does my Chase account say balance updates currently unavailable?

Are you getting ‘Balance updates currently unavailable’ error on Chase and wondering what does it mean?

If that’s the case, you have landed on the right page. Here, we have explained all you need to know.

So, let’s get started.

Chase Bank is a full-service financial institution that has more than 4,700 locations and 16,000 automated teller machines (ATMs).

It provides a wide variety of financial goods and services to both private consumers and commercial enterprises.

Chase is well-known for its comprehensive credit card options, which include some of the most popular travel rewards and cash back credit cards. The company also offers checking, savings, and certificate of deposit accounts.

Chase is able to meet the majority of requirements thanks to the availability of accounts tailored to adults, students, and children.

What does it mean when chase says balance updates currently unavailable

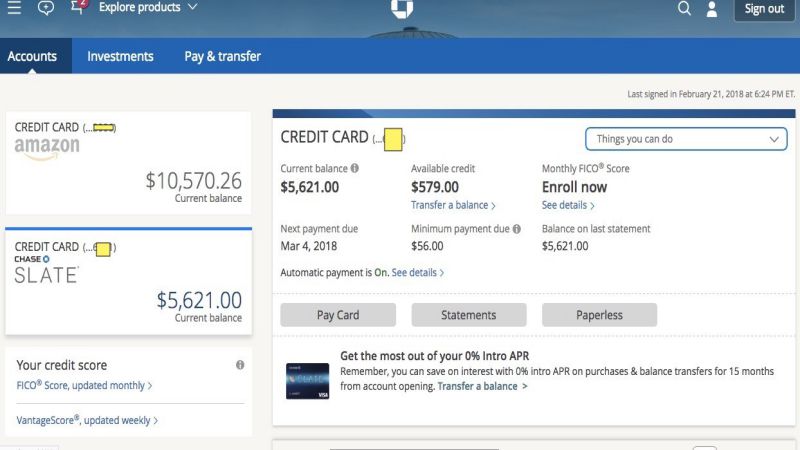

When chase says balance updates currently unavailable it usually means a problem that occurs when which users are unable to get or see the balance changes. Experts believe that one of the primary factors contributing to such an inconvenience is the presence of servers with bugs.

Users around the United States have likely encountered the frustrating circumstance when they were unable to check their Chase account balances.

When the problem has been going on for a while, the severity of the message “Balance updates are currently unavailable Chase” grows, despite the fact that it first seemed to be less concerning than it ultimately turned out to be.

Numerous clients have voiced concerns over the disappearance of funds, while others have discovered unexpectedly more balance than what they are actually supposed to have.

Those customers who had lost money were in a state of panic because they suspected that their bank had been hacked.

Likewise, customers who were left with extra money in their bank account were concerned because they dreaded the prospect of being falsely accused of unethical behaviour that they had not engaged in.

A significant number of Chase account holders were unable to see their transactions or balances for consecutive days.

One of the customers had also stated that they were unable to cancel their credit card because Chase was unable to establish a connection to its system.

Why is my Chase balance not available

There are a variety of reasons why your Chase account balance could not be accessible. There could be an issue with the server, or Chase might be in the middle of doing some required website maintenance, or the website itself might be down. It’s also possible that one of the reasons is that you’re using the Chase app in a country other than the United States.

If you are receiving an error text from Chase stating that Balance updates are currently unavailable, then there is no problem with the balance of either your bank account or your credit card.

-

1. Service maintenance

The most likely explanation is that Chase could be carrying out obligatory service maintenance.

The members of the technical team examine the Chase app and website in search of any errors or bugs that might be present.

They examine the servers to see whether they are operating normally and then update them if that is required.

-

2. Server issues

Another reason could be there may be problems with the server that are preventing access to the website.

It is highly possible that their services for processing transactions and updating balances are experiencing some difficulties.

-

3. Outside United States

Also, gaining access to the updates of your balance may be difficult while you are outside the US. Outside the United States, the servers are not very reliable.

There is a possibility that the internet connection at the place where you are staying may prevent you from accessing the Chase mobile app or website.

How to Fix Balance updates are currently unavailable Chase Error?

Method 1: Clear your browser cache

If you see a notice from Chase saying that “Balance updates are presently unavailable,” it’s not your browser’s fault. To be safe, clearing cache is always a good idea.

The cache is a short-term memory that all of our gadgets, whether they are personal computers or mobile phones, hold in order to speed up the loading of applications and increase the performance of such applications.

However, as time passes, the volume of data increases, and rather than bringing about advantages, this might bring about problems.

Clearing your cache and cookie data is highly recommended since websites may sometimes get stuck on an earlier version of themselves.

Even if there is a possibility that the problem with the balance has been resolved, you are still seeing the notice since the most recent page is unable to load.

Follow the steps below to clear the cache on Chrome:

- Step 1: Click on the menu (the three dots at the top right).

- Step 2: Select Settings that is towards the end.

- Step 3: Choose Privacy and Security.

- Step 4: Click on Clear browsing data.

- Step 5: Choose the details you want to delete on the window that pops up.

- Step 6: Click on Advanced tab beside the primary account.

- Step 7: Next, you can choose to delete the password and autofill information.

- Step 8: Click on Clear data.

Note: Remember your password and username in case you decided to delete cookies as you will have to log in to Chase again.

Method 2: Update the Chase App

There may be a number of hidden flaws and mistakes impacting the app’s functionality if you are not using the most recent version.

You may get the most recent improvements and make sure there are no issues by updating to the most recent version of the Chase app.

Follow the steps below to update the Chase app:

- Step 1: Open the Play store or App store.

- Step 2: Search Chase App on the search toolbar.

- Step 3: Open the Chase App page.

- Step 4: Click on Update option.

Method 3: Submit a Complaint

If there is a problem with the Balance updates at the moment, when a mistake with Chase continues for days despite repeated attempts to contact the company’s Support personnel, it’s advised to take severe measures to get the company to resolve your issue.

Make a formal complaint to the Consumer Financial Protection Bureau about your experience with Chase.

It’s the US government’s official website for consumer finance safety information. Companies usually react to institutional pressure within a week and a half.

Method 4: Contact Customer Support

Complaints are the sole course of action available for consumers to take in the event that the problem is a technical one.

The number of customer complaints received in a single day compels financial institutions to work feverishly to resolve their technological problems.

- If you have a personal account on Chase then you can contact Chase’s customer support by calling on +1 800 935 9935.

- If you have a business account on Chase then you should call 1-877-242-7372.

- If you’re at the moment not in the US but outside of the country, you can call 1-713-262-3300.

- If you happen to be a Merchant using the Chase app then the helpline number is 1-888-886-8869.

- You can also get support from Chase Accessibility Services page from their official website.

- If everything fails then as a last resort you can visit a Chase bank branch.

SEE ALSO: [Fixed] Chase App Features Temporarily Limited

FAQs

1. Is Chase Bank safe?

Chase Bank takes the security of its clients very seriously and uses a variety of methods to do so.

The most up-to-date encryption methods, together with many layers of authentication and constant monitoring of user activities, make up the security infrastructure.

2. What do I do if I don’t receive the statement credit or rewards that I’ve earned?

Make sure you’ve satisfied all the requirements listed in the offer’s T&Cs before requesting a redemption. Chase.com/getmorenow features all the current deals.

Our credit cardholders have access to a diverse set of merchant discounts, each with its own set of eligibility requirements.

In the event that you have fulfilled the necessary steps but have not received the statement credit or earned rewards within two billing cycles, please contact Chase using the number listed on the back of your participating credit card.

3. Why did Chase put my Check on hold?

It’s possible that Chase will place a hold on your check for a number of reasons.

This may include the person who wrote the check doesn’t have enough money in their account to cover the amount of the check, you’re a new customer at Chase, the amount of the check deposit is suspiciously large, a history of frequent overdrafts, or a previous instance of the check being returned unpaid.

Final Words

Every website and app will, at some point, experience some kind of technical difficulty.

Chase’s website and mobile app have been the subject of complaints of unexpected power outages as well. The modifications to the Balance are not accessible at this time.

The easiest way to resolve issues with Chase’s messaging is to file concerns directly with the Chase support staff.

On your end, there is not much more that can be done, particularly on the technological front.

Further Reading:

Fix: Chase offers not showing up (Reasons & Solutions)

Fix: Chase Direct Deposit not showing up

[6 Reasons] Why did Chase put a hold on my Check

[Fix] Chase coverage not working for debit card

Having earned a Bachelor’s degree in Commerce from Ravenshaw University, with a background in Accounting and Finance, Akshita Pattanayak contributes to UniTopTen by writing clear and concise articles based on Finance-Tech. With more than a hundred fin-tech related articles, she hopes to educate people about how banking and payment apps function.