The Toronto-Dominion Bank (TD) is a global organization that has an illustrious track record of service that dates back sixty-five years.

It is the biggest bank in Canada in terms of asset size, and it is an undisputed member of the “Big Five” banks in the country.

In addition to the plethora of other financial services that it provides, TD also allows you the opportunity to conduct international money transfers.

This includes cash transfers via its association with the world’s largest currency exchange company, Western Union.

Why is TD Global Transfer not working?

Short Answer: TD Global Transfer is not working because you are using an outdated app, you do not have a personal account in either Canada or the United States that is eligible for TD Global Transfer, you do not have a Canadian address in your TD profile, or the address you have provided is incomplete.

1. App not updated

If you are experiencing problems accessing TD Global Transfer, make sure that you have the most recent version of the TD app installed on your device before attempting to access the service again.

An outdated app may not function properly, as a result of which the TD Global Transfer will not be successful.

2. Non-Canadian Address

When transferring money to an account with a TD Global Bank Transfer or when sending money for Cash Pick-up with Western Union, your TD profile must have a valid Canadian address for the transaction to be successful.

Otherwise, the TD Global Transfer will not work.

3. Incomplete address

It goes without saying that in case you have skipped a part of the address that is required for the TD Global Transfer, your transaction will not go through.

Ensure you enter a valid and complete address while making an international transaction.

4. Bank Account not eligible for TD Global Transfer

If your bank account isn’t compliant with TD Global Transfer, your attempt to make an overseas transfer will fail.

How long does TD Global Transfer take?

If you send money abroad using TD Global Transfer, it will often reach its destination within three working days. However, in certain circumstances, it may take up to 5 business days.

The projected arrival time of a TD Global Transfer varies depending on the country of destination, the currency chosen, and the transfer method selected.

At the outset of the procedure, selecting “Get estimates” will show you the expected arrival time for each transfer option.

Your transfer confirmation and the transfer information in your Transaction History will now include an approximate arrival time.

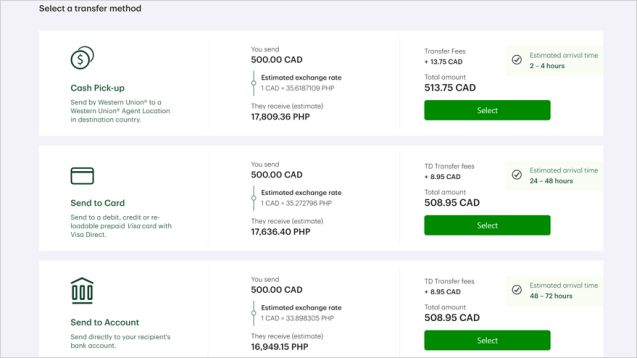

According to estimates, this is how long it will take for each kind of transfer:

1. Send to Account: anywhere between 24 hours to 10 business days. The time it takes for your money to arrive depends on the nation it is being sent to.

2. Send for Cash Pick-up: within 2-4 hours

3. Send to Card: typically takes 1 or 2 days, except in the United States, where it will be accessible in 2- 4 hours.

How to send TD Global Transfer

-

Step 1: Go to Send Money

Access the TD Bank app. Select Send Money from the main menu.

Choose the tab labeled “Globally” inside the Send Money window.

-

Step 2: Register yourself

Go ahead and click the “Get started” button. Examine and double-check your profile details.

Select “Edit” to make changes to the current display. If there are no changes to be made, click “Continue”.

Take a look at TD’s privacy and terms of service policies. Select the box for “Accept TD Terms of Use and Privacy Terms” if you agree to the terms.

Your registration will be confirmed once it is complete. Click the “Send money now” button to get started.

-

Step 3: Get an estimate

Choose the country where the money will be sent. For other options, please use the ‘Destination’ menu.

Include the state and/or city if necessary for the country.

In the area labeled “Send amount,” type the amount you want to send.

Pick the “They’ll receive” tab if you’d want your transfer to be based on how much money the receiver gets.

You may also have the option of specifying the receiving currency for the transfer.

Choose Get estimates to see your alternatives. Check your methods of transfer.

These options may not always be accessible, depending on variables including the amount being transferred, the currency being used, and the country to which it is being sent. The methods are:

1. Send to Account: Make a direct deposit into the recipient’s bank account.

2. Cash Pick-up: Get your money to the receiver at a Western Union office in the recipient’s country.

3. Send to Card: Money may be deposited into a Visa Prepaid Card, Visa Debit Card, or Visa Credit Card.

We give estimates for the arrival time, transfer costs, and exchange rate.

-

Step 4: Choose and confirm the transfer method

Choose the mode of transfer that works best for you.

Check the transfer information and the TD Important Information section on the Confirm your rate screen.

To modify, click the option labeled “Search again.” When you’re ready to go on, click the Continue button.

Examine the caution on the Fraud awareness screen. After reading, click the Continue button.

-

Step 5: Enter the transfer details

Use the “From account” option to choose the account that will be used to make the transfer.

Accounts that are permitted to make the transfer appear in the dropdown menu.

Use the drop-down to choose the person you wish to send money to.

If you don’t see the person you want to send on the list, you can always add them by clicking the Add recipient button.

Proceed by clicking the Continue button.

-

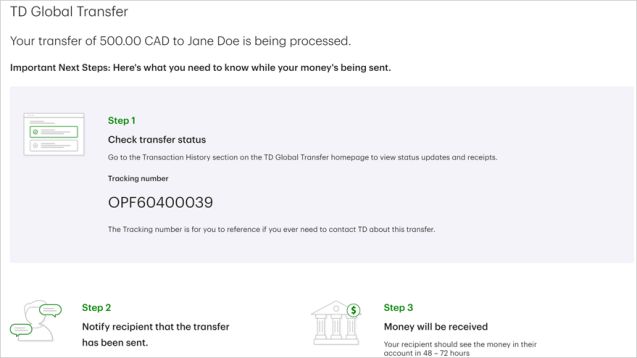

Step 6: Examine the details and confirm the transfer

Check your transfer information to make sure everything is proper. You may go back and make adjustments by clicking the Back button.

Click the ‘Send money’ button to complete the transaction.

A notification indicating your transfer is in progress along with a tracking number should be sent to you.

Once the transfer is complete, follow the on-screen prompts. The specifics depend on the kind of transfer used and the laws of the country to which the funds are being sent.

You may check the status of your transfer and make further payments from this page.

TD Global Transfer limit

The maximum amount you may transfer with TD Global Transfer depends on the payment option you choose. There are also daily, weekly, and monthly limits on how much you may send. During the TD Global Transfer procedure, you will be warned if you exceed these restrictions.

Following are the limits for each service:

-

TD Global Bank Transfer: up to $6,500 per transaction per day

-

Visa Direct: up to $2,500 per transaction per day

-

Western Union: up to $999.99 per day

To check your TD Global Transfer, follow these steps:

- Step 1: Log in to the TD app

- Step 2: Select Send Money from the top of the screen

- Step 3: Select the Globally tab

- Step 4: Input the destination country

- Step 5: Select “What are my sending limits?”

The page detailing TD Global Transfer’s sending restrictions details both the individual transfer method limits and the total transfer limit.

TD Global Transfer fees

TD Bank claims that its transfer costs are variable. In other words, they might vary depending on factors including the recipient’s currency, the service type, and the sender’s account status. Each transfer may cost as much as $25 in fees.

Visa Direct fees are subject to this variable pricing system. When you ask for a quotation using this service, you’ll see the exact cost associated with your transfer.

Transferring $10,000 or less through an international wire from a bank costs a minimum of $30. Fees of $50-$80 are possible for sums more than that.

Fees for sending money with Western Union can change depending on where the sender is located and other criteria.

Keep in mind that TD Bank may charge you a fee for making a standard transaction from your account, in addition to any transfer costs that may apply.

FAQs

1. Is sending money with TD Bank safe?

Many people in North America rely on TD Bank as their primary financial institution.

In addition to traditional banking services like checking and savings accounts, they also handle a substantial amount of investment capital.

There are various safeguards in place to ensure the safety of the facility’s visitors and employees.

If you access your bank account from an odd place, for instance, the bank may request a security code to verify your identity.

Final Words

As a TD customer, you can rest easy knowing that your money is being handled by one of the world’s most recognized and top-quality institutions.

The Toronto-Dominion Bank is a trusted and world-class partner for your daily banking requirements.

However, TD leaves a lot to be desired when it comes to pricing specifically surrounding international money transfers.

As we’ve seen, TD isn’t exactly forthcoming about how much it costs to make these transactions, and the bank is already expensive.

Furthermore, if you want to transfer a very significant quantity of money overseas, TD may be much more restricted.

Further Reading:

Why would TD Bank close my account ( 7 Reasons)

Why is my TD credit card not working

Why is TD debit card advance not working (12 Reasons)

How to Fix: TD Interac e-transfer not working

Having earned a Bachelor’s degree in Commerce from Ravenshaw University, with a background in Accounting and Finance, Akshita Pattanayak contributes to UniTopTen by writing clear and concise articles based on Finance-Tech. With more than a hundred fin-tech related articles, she hopes to educate people about how banking and payment apps function.