Are you not able to overdraft with Varo?

If you are struggling with overdraft on Varo, or it’s not working for you, you have landed on the right place. Here we have explained all you need to know about over drafting with Varo.

So let’s get started.

Does Varo have overdraft

Yes, Venmo does overdraft of up to $50 as long as you meet the requirements for eligibility.

Can I overdraft my Varo card

Yes, you can use your Venmo debit card to overdraft your account up to $50 as far as you are eligible.

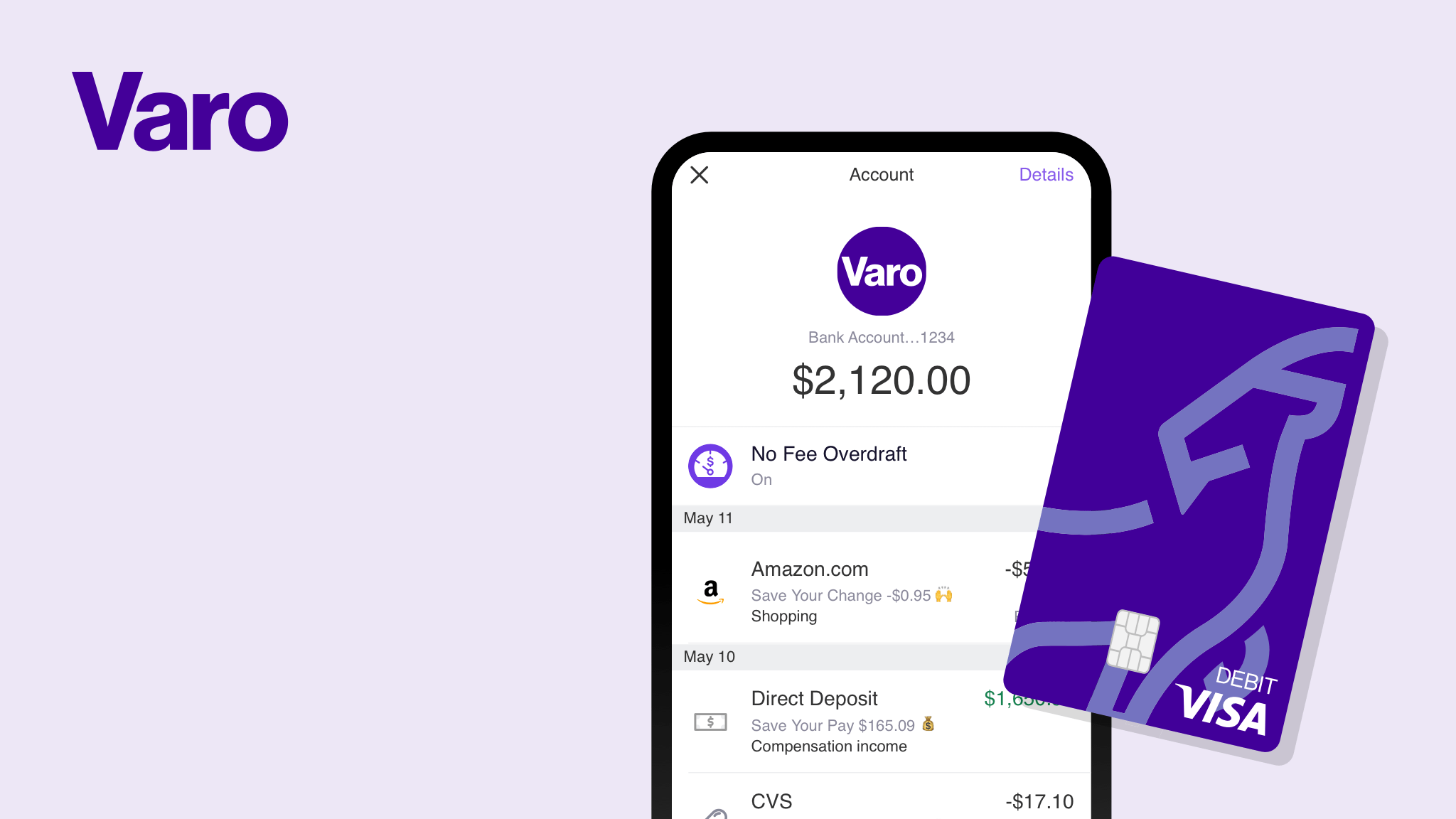

How to turn on no fee overdraft Varo

Varo offers overdraft of up to $50 and that too with no fee (with some conditions). You can turn on the no fee overdraft on Varo by following the steps below:

- Open Varo app

- Login to your account, if you haven’t already.

- Go to Checking section in the Varo app

- Tap Varo Bank Account.

- Now, select ‘No Fee Overdraft‘.

So, that’s it. This is how you can turn on the no fee overdraft on Venmo.

Note: Varo no fee overdraft comes with certain conditions: *To be eligible for No Fee Overdraft, customers must make at least 5 Varo Visa Debit Card purchases each calendar month; and receive payroll or government direct deposits of at least $1,000 each calendar month into their Varo Bank Account.

For detailed terms and conditions of no fee overdraft on Varo, you can read this brochure.

Varo overdraft limit

Varo overdraft limit is up to $5o.

Varo also offers a cash advance, using which you can borrow up to $100, but it comes with a fee. However, you can still get $20 without any fee, if you are eligible.

Why is my Varo overdraft not working

Varo overdraft may not work for you because of several reasons such as you do not meet the overdraft eligibility requirements, you haven’t turned on Varo no fee overdraft feature, you haven’t repaid previous overdraft on time, or there is a technical issue from Varo’s side.

Below, we have explained all the reasons why Varo overdraft may not work for you.

1. You do not meet the Varo overdraft eligibility requirements.

Yes, to overdraft on Varo you need to fulfill a few requirements. If you are not eligible for Varo no fee overdraft, it will not work for you or won’t be available for you.

To be eligible for Varo overdraft, you must fulfill the following requirements:

- You must make at least 5 Varo Visa Debit Card purchases each calendar month.

- You must have received payroll or government direct deposits of at least $1,000 each calendar month into your Varo Bank Account.

For more details on requirements, you can read this brochure.

2. You might have not turned on Varo no fee overdraft

Another reasons why Varo no fee overdraft is not working for you is that you haven’t turned it on.

Yes, before you can use the overdraft on Varo, you have to turn it on in the setting.

Follow the steps below to turn on no fee overdraft on Varo, if you eligible:

- Open Varo app

- Login to your account, if you haven’t already.

- Go to Checking section in the Varo app

- Tap Varo Bank Account.

- Now, select ‘No Fee Overdraft‘.

3. Don’t get confused with Varo Advance

Yes, do not get confused with Varo advance and Varo overdraft. These are two different types of money borrowing features that Varo offers.

If you opt for Varo advance, you can get a cash advance of up to $100, but it comes with a fee. On the other hand, Varo overdraft is only up to $50 and is free.

Varo Advance |

Fee |

|---|---|

| $20 | $0 |

| $50 | $3 |

| $75 | $4 |

| $100 | $5 |

To qualify for a Varo Advance your account must be at least 30 days old with a balance of $0.00 or greater, with qualifying direct deposits in the Varo Bank Account and/or Varo Savings Account of at least $1,000 over the past 31 days.

Your Varo Bank Account and/or Savings Account must not be overdrawn, and your Varo Bank Account cannot be suspended or closed.

For $20 Advances, your qualifications will be evaluated daily. For Advances over $20, fees apply, and your payment history and qualifications will be reviewed monthly for any credit limit increases.

To continue to qualify for Advances, payments must be made timely.

4. You haven’t repaid previous overdraft on time

Another reason could be that you haven’t paid the previous Varo overdraft on time and that’s why Varo might have flagged your account to use the overdraft feature.

So, make sure to repay the overdraft money on time to avoid any fees and ability to further overdraft.

5. You are over drafting too frequently

Another potential reason why you can’t overdraft on Varo might be that you are using the overdraft feature too frequently.

If you are using overdraft too frequently, Varo might block your access to further overdraft due to certain reasons, even if you are repaying the money on time.

We don’t know what count would be too frequent to overdraft on Varo, but yes, it could be one of the reasons why you are not able to use overdraft on Varo.

In this case, you can wait for a few days or weeks to overdraft your Varo account.

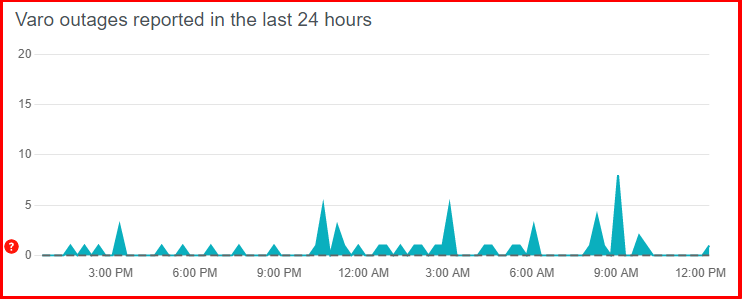

6. Servers of Varo are having issues

It’s generally a good idea to know whether the issue lies on the client-side or the server’s side.

If the problem is on the Varo’s end, there isn’t much you can do to fix it. In that case, the only way left would be to either wait till the issue gets resolved or report it via Varo help and support channels.

That being said, to check the server’s status of Varo, there are a lot of free online services.

We would recommend checking Downdetector’s page for Varo. Here, you can check the live map and comments section to see if other users in your area are reporting similar issues.

Similarly, you can check IsTheServiceDown’s page for Varo. Like Downdetector, it also provides detailed reports of past outages and user-reported problems as well.

If the outage services show no issues with Varo servers, it’s very likely that the problem is on your side.

Final Words

Varo is an American online only bank based in San Francisco, California. . The company provides financial services through its mobile app and currently has 1 million customers.

Varo provides no fee checking and savings accounts, as well as no overdraft fees. It also provides tools to help budget and keep track of spending, as well as free ATM withdrawals through its Allpoint partnership.

Well, sometimes you might have issues while using some of the features of Varo, such as what we discussed today in this post.

So, that’s for now, guys. After reading this post, we hope you were able to know everything about Venmo overdraft and why is may not be working for you. To read more posts like this, follow a few related Varo posts below or visit our Varo section.

Further Reading:

How to get money out of Varo without card

How to borrow money from Varo: Guide

[Fixed] Varo closed my account with money in it: Reasons

Does Varo bank have Zelle? How to add Varo card in Zelle?

Does Earnin work with Varo (2021)

Ankit Kumar is an Engineer by profession and a blogger by passion. Over the last several years, he has written tons of articles, solving queries on Quora. He also has years of experience in investing in Cryptocurrencies, Funds, and Stocks.