To stop Cash App from charging you a fee every time you receive a payment, you will have to switch your Cash App account from a business account to a personal account.

There are two sorts of accounts that may be opened with Cash App: a personal account and a business account.

The personal account is primarily used to send and receive payments to and from friends and family members, and its usage is free of any fee or charges.

The business Cash App account is available for use by owners of businesses.

This account has several advantages over the personal Cash App account, including the ability to receive an unrestricted number of payments, to create a personalized $Cashtag, have a cool icon next to your profile, and several other perks.

However, there is a minimal fee that is associated with maintaining a Cash App account for a business.

A charge of 2.75 percent will be deducted every time you receive a payment from your customers or clients.

Why does Cash App take money when you receive (without permission)

Cash App will take money from you when you receive a payment if you have a business account set up on the Cash App instead of an individual account. Furthermore, the app will charge you a fee if you wish to withdraw your funds right after receiving them.

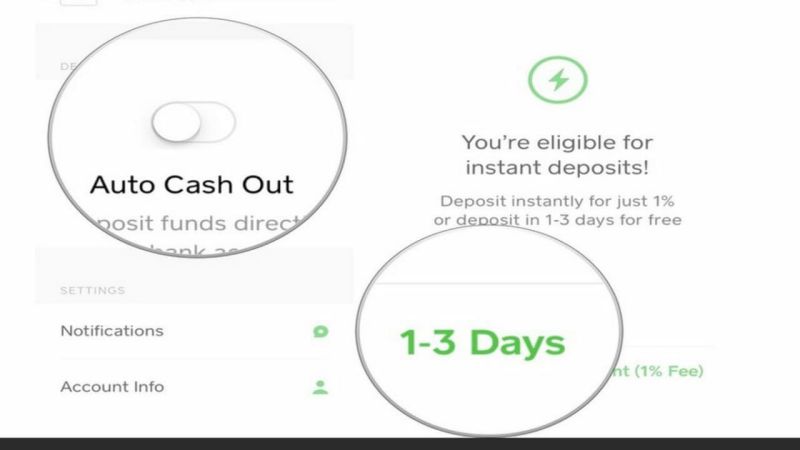

There is a charge of 1.5% for making an instant deposit from your Cash App to your bank account, which you will be responsible for paying if you receive money via Cash App and want to withdraw it immediately.

Cash App generates its revenue by charging companies to use their service and by charging personal users transaction fees to access extra services.

This business model allows Cash App to attract and retain a large customer base.

Businesses who accept Cash App payments are subject to a transaction fee of 2.75 percent every Cash App payment. There are two options for completing these transactions:

- A person initiates a peer-to-peer in-application transaction to send money to a company.

- A person uses the Cash Card, which is a Visa prepaid card that users may buy and is connected to their in-application balance in order to send money to a business.

You agree to pay the fees notified to you at the time you create an account on the Cash App for a Business account.

At the time of processing a transaction, all fees are taken from the transferred or collected funds.

Cash App reserves the right to change the fees upon reasonable advance notice. All Balances and all fees, charges, and payments collected or paid through the Payment Services are denominated in US dollars.

How to stop Cash App from taking a fee when receiving money

If you don’t own or manage a business, change your Cash App account to a personal account to avoid fee when receiving money. Register a second Cash App account to avoid incurring fees while receiving cash from friends and family. Cash App’s terms of service don’t prevent separating business and personal transactions.

If you really use Cash App for your business, you should not switch to a personal account from a business account because doing so is against the terms and conditions of Cash App, and it is highly possible that you might get kicked off of Cash App due to the violation of their terms of service.

It is advised that you open a second personal Cash App account if you want to avoid being charged a fee while receiving money from close friends and family members who also use Cash App.

You will not be in violation of the terms of service for using Cash App if you use this approach to ensure your business transactions are separate from your personal transactions.

Nevertheless, if your Cash App has somehow been setup as a business account, Cash App provides its users with the feature to convert your account from a business account to a personal account by following the steps that are listed below:

-

Step 1: Open the Cash App.

-

Step 2: Select the button shaped like a circle for your profile

Now, in the upper right corner, pick the button shaped like a circle for your profile.

-

Step 3: Choose the “Personal” option

Following that, choose the “Personal” option from the selection that drops down.

-

Step 4: Select “Change Account Type” option

Keep scrolling down until you reach the bottom of the page, where you will see the option to “Change Account Type”. Select this option.

-

Step 5: Scan your finger or enter the PIN

Scan your finger or enter the PIN if you are certain that you want to switch your Cash App account from business to personal.

After you successfully convert your Cash App account from business to personal by following the steps mentioned above, you will notice that Cash App no longer charges a fee every time you receive a payment.

How do I avoid the Cash App fee?

You may avoid fees by not using a credit card while transferring money or instant deposit when moving Cash App money to your bank account. If you receive $300 or more in approved direct deposits into your Cash App account, you may get ATM charge reimbursements and avoid certain withdrawal fees.

With a few notable exceptions, Cash App will not normally charge a fee for sending or receiving money.

This, however, is not always the case. There is a charge of three percent that will be assessed when you transfer money via Cash App using a credit card.

There is a charge of 1.5% for making an instant deposit, which you will be responsible for paying if you receive money via Cash App and wish to withdraw it straightaway.

When sending or receiving money with Cash App, you may avoid incurring fees by not using a credit card to transmit payments or by avoiding the instant deposit option when transferring your Cash App money to your bank account.

In the event that you receive $300 or more in qualified direct deposits into your Cash App account, you will be eligible for ATM fee refunds, which will allow you to avoid paying certain ATM withdrawal costs.

Every thirty-one days, you are eligible to get three reimbursements, each of which may be valued a maximum of $7.

SEE ALSO:

- Why Can’t I Activate My Cash App Card

- How To Stop Cash App From Taking Money Automatically (Recurring Payment)

- If Your Cash Card Is Disabled, Can You Still Receive Direct Deposit

- Why Recipient’s Account Is Unable To Accept Payments Cash App

- How Do I Link My Bank Account To My Cash App Without A Debit Card

FAQs

1. What kinds of services are available on Cash App?

Both peer-to-peer (P2P) payments between users and invoicing enabling users to pay companies directly from inside the app are available on Cash App.

Along with equities and exchange-traded funds (ETFs), cryptocurrencies such as Bitcoin may also be purchased and transferred using this app.

You may make direct deposits to your Cash App account using the banking services, and your Cash App account comes with a debit card (the banking services and debit cards are both offered by banking partners of Cash App).

2. What is the difference between Cash App Personal and Business accounts?

Cash App accounts may send and receive payments.

Users who wish to send or receive personal payments for shared expenses, such as a meal bill or a rental fee, as well as shop and make payments online, should establish a personal Cash App account.

The Cash App business account is for corporations and organizations.

It gives extra features such as the option to establish their own payment link, which allows those who don’t use the Cash App to make payments using that link without creating their own Cash App account, and a larger transaction limit, which allows it to handle a bigger number of payments.

3. Can I cancel a Cash App transaction?

Due to the instant nature of Cash App transactions, cancellations are not possible after you have made a payment.

If you send money to the wrong person or make an accidental payment, you may use Cash App’s request feature to ask for your money back, albeit there’s no assurance that you will really get it back.

That’s why you should always thoroughly check your $Cashtags, phone numbers, and the amount of money you are transferring before completing a transaction in Cash App.

Final Words

Cash App is a secure online payment platform that enables customers to easily transfer money across accounts.

Users can choose between personal and business accounts while registering for an account on Cash App.

A business Cash App account is designed for use by commercial enterprises that want to collect payments from a sizable number of individual clients whereas, a personal Cash App account is more suited for people who just want to send and receive money to and from their friends and family members.

The Cash App prioritizes keeping things as straightforward and easy to use as possible.

Changing Cash App from a business account to a personal account or from a personal account to a business account is just as easy.

Having earned a Bachelor’s degree in Commerce from Ravenshaw University, with a background in Accounting and Finance, Akshita Pattanayak contributes to UniTopTen by writing clear and concise articles based on Finance-Tech. With more than a hundred fin-tech related articles, she hopes to educate people about how banking and payment apps function.