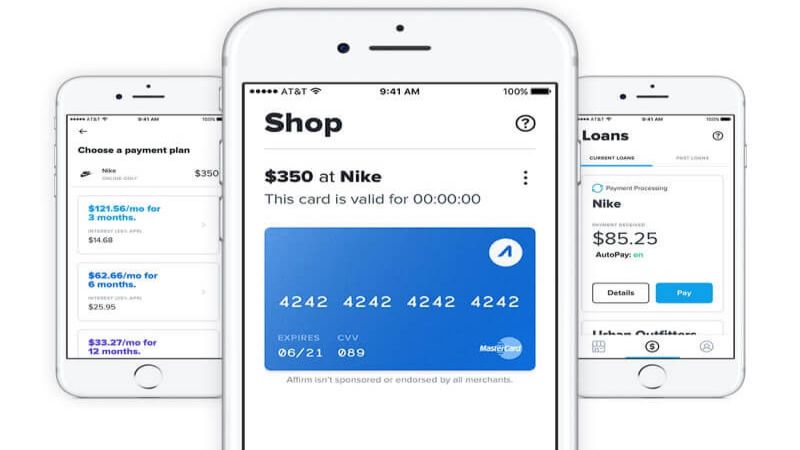

You cannot get cash from Affirm virtual card. This is because the Affirm virtual card is a one-time use credit card with a distinct number that can only be used for making purchases online or at a store once a loan has been granted.

Affirm is a financing business that facilitates the purchase of products and services from online retailers in exchange for a loan, with repayment split into equal monthly instalments.

When you use Affirm, you won’t have to worry about paying any late fees, service costs, prepayment fees, or any other kinds of hidden fees since they don’t charge any of those things.

If you are authorized for a loan using their mobile app or on their website, Affirm.com, you will have the option to have the amount of the loan deposited into a virtual Visa card.

It is valid for a single purchase at a retailer of your choosing, either online or in-store, and may only be used once.

Can you get cash from Affirm

Yes, you can get money from Affirm through the Affirm app or their website. For withdrawals above $25,000, you must utilize an external bank.

Anyone can receive cash from Affirm by either downloading the Affirm app or visiting the Affirm website. Both options are available to you.

However, there is a restriction of $25,000 per person transaction and a maximum of $100,000 per day for withdrawals that are initiated via Affirm.

If you want to withdraw a larger amount, you may be required to utilize an external bank.

It is possible that you may need to get in touch with Affirm Support in order to get assistance with a withdrawal. They will check your request and assist you with the withdrawal of your funds.

How to get cash from Affirm virtual card

You cannot get cash from Affirm virtual card as it is a one-time use card with a distinct number that you input during checkout after being authorized for a loan. This card functions like any other credit card, making cash withdrawals impossible. However, if you have an Affirm savings account, you may withdraw cash at any time.

In the event that you do not use your virtual card within twenty-four hours of its issuance, you will not be charged for its usage.

It is also not a problem to spend just a fraction of the available finances. You will only be responsible for paying back the amount you actually spent, plus any interest that has accumulated.

When you make a purchase using your virtual card online, the transaction is processed the same way a regular credit card transaction would be.

To pay with a credit card, choose that option as the payment option at checkout, then input the card details and any other information that is required.

On the other hand, if you need cash, you may always withdraw it via your savings account.

Method 1: Through affirm.com

-

Step 1: Create an account with Affirm.

-

Step 2: Choose Save.

-

Step 3: Choose Withdraw.

-

Step 4: Type in the amount you wish to withdraw.

-

Step 5: Choose the bank account you’d want to withdraw cash from

Choose the account you’d want the funds to come from under the “From” drop-down menu.

-

Step 6: Choose Confirm.

To finalize the transfer, check the information and click the Confirm button.

Method 2: Via the Affirm app

-

Step 1: Launch the Affirm app.

-

Step 2: From under Savings, click on See account.

-

Step 3: Click on Withdraw.

-

Step 4: Type in the sum you would like to withdraw.

-

Step 5: Choose the bank account you’d want to withdraw cash from

Choose the account you’d want the funds to come from under the “From” drop-down menu.

-

Step 6: Choose Confirm.

To finalize the transfer, check the information and click the Confirm button.

FAQs

1. Do you need a credit card to use Affirm, or can you use it without one?

You can use Affirm even if you don’t have a credit card. If Affirm denied your loan request and you don’t own a credit card, this isn’t always due of this fact.

Possible causes include a limited credit history, bad credit, or failing to satisfy the specific criteria of the store you’re seeking to finance a purchase from.

2. When using Affirm, what minimum credit score is required?

You can’t get an idea of your eligibility for an Affirm loan by looking at the minimum credit score required.

Once again, your eligibility is determined by your credit score, your time spent with Affirm, and the state of the economy.

But in general, if you have good credit, you may have an easier time being accepted for a point-of-sale instalment loan.

3. What are the consequences of not paying my Affirm balance?

Since Affirm does not implement any fees, you will not be subjected to any late payment penalties.

However, if you default on your loan or make payments that are late, Affirm may reconsider your loan application in the future.

A negative impact on your credit score might result from payments being reported late or not made at all.

In the event that you fail to make payments for longer than 120 days, Affirm has the right to charge off your loan.

SEE ALSO: How does Affirm work at Walmart (Guide)

Final Words

In the proper hands, financial services like Affirm may be quite helpful. It completely conforms to all privacy regulations in the market today.

Two-factor authentication necessitates the use of a mobile phone number in conjunction with account creation and sign-in.

Neither late fees nor penalties are assessed by Affirm, unlike credit cards, nor is compound interest (interest on interest) charged.

Affirm’s loan terms are advantageous since interest is assessed only on the main debt rather than the whole loan amount.

In addition, the firm guarantees that the interest rate will be stable and fixed during the time of borrowing.

It’s possible to have many Affirm loans at once. If you are behind on payments for one of your Affirm loans, you may not be eligible for any new loans until you catch up.

It is crucial, however, that people review the fine print and fully understand the rate of interest and timeframe.

Further Reading:

(2022) Does Stockx accept Afterpay, Affirm (Workaround Guide)

Does Affirm take prepaid cards?

(Solution) Why is my Affirm virtual card not working

Having earned a Bachelor’s degree in Commerce from Ravenshaw University, with a background in Accounting and Finance, Akshita Pattanayak contributes to UniTopTen by writing clear and concise articles based on Finance-Tech. With more than a hundred fin-tech related articles, she hopes to educate people about how banking and payment apps function.