There is a numerical value assigned to your creditworthiness, known as your credit score. Keeping a healthy financial situation includes regularly checking your credit score, so it’s irritating when you can’t locate it and you don’t know why.

We’ll go through the most prevalent causes why your Experian credit score could not be popping up, whether you’re just starting with credit or it recently vanished, so you can restore it appropriately.

Why can’t I get my Experian credit report online?

Short Answer: You can’t get your Experian credit report online because you are sharing incorrect required details. There might also be a problem with the credit report itself, or the address you provided might not match the one the credit bureau has on file.

1. Wrong answers

There are several possible causes for giving the wrong answers. Accounts that a person does not have may be inquired about on occasion. The obvious response is “none of the above.” Nonetheless, making a hasty decision due to uncertainty is always a risk.

Some people have trouble remembering the names of their creditors or the exact amount they have paid toward their loans. Both are often asked, and if you don’t know the answers, you can make a mistake.

2. Address does not match

Secondly, some individuals have trouble recalling the titles of the streets they formerly called home. If someone resided on the street 50 years ago, they may not remember what it was called.

3. Technical error

The absence of your credit report may be the result of a technical fault (either a technical glitch or a credit reporting mistake). If you believe there has been a problem with your report, please contact the company immediately by phone or mail.

Why is my credit score not available on Experian?

Short Answer: It’s conceivable that you don’t have a credit score if you’re checking for the first time and obtaining results like “credit score unavailable” from the proper source. You don’t exist as far as the scoring system is concerned. Retirement might also be a factor in individuals cutting down on their regular use of credit, resulting in an unavailable credit score.

If you haven’t created a credit account before, have just recently begun using credit, or if your creditor isn’t registering your account activity, this might be the case. There is no way to get a credit score if you haven’t used credit in over a decade since your previous accounts will have been removed from your credit report.

Credit scores are a numerical representation of the data included in a person’s credit report. There have to be at least a couple of open credit accounts for the majority of credit scoring algorithms to provide a score. They also need something to do over the last three to six months.

Once they’ve paid off their house and vehicle loans, retirees may discover they have less need for and fewer opportunities to utilize credit. They may not be aware that their credit history can be gone by the time they need it.

Having a decent credit score requires that you maintain at least a number of open credit accounts, regardless of how stable your financial circumstances may be. There is no need to incur debt in this situation. Lenders will see that you are handling credit responsibly even if you just use your card for little transactions and pay off the debt in full every month.

How to get my credit report on Experian

-

Step 1: Sign up for Experian or access your existing account

You may join up for Experian or access your existing account by visiting Experian.co.uk.

-

Step 2: Select “Credit Score & report”

-

Step 3: Next, select “Experian Credit Score & Report”

-

Step 4: Click on the ‘Print or Save’ button in the upper right

After logging in, there will be a ‘Print or Save’ button in the upper right, next to the ‘Alerts’ symbol. To proceed, please click here.

And that’s the whole thing! In a different tab or window, you may see your credit report. The whole Experian credit report is yours to see, download, and print. To view the Experian website with the option to “Print or Save,” a desktop browser is required.

Why is Experian not showing my credit score?

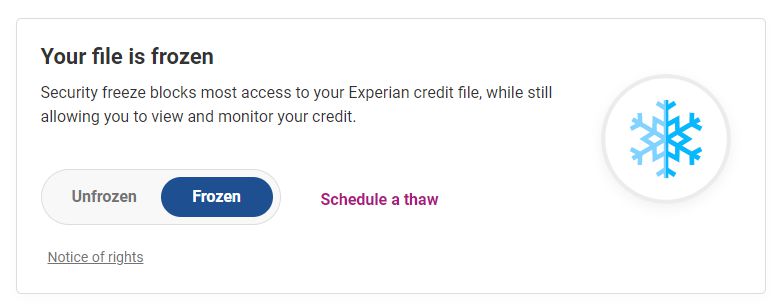

Your credit file may be frozen, you may not have a credit report, or your credit history may be too short for Experian to display your credit score.

In an effort to avoid identity theft, some people freeze their credit files. However, they often neglect to unfreeze their credit on Experian before registering for credit. Credit scores cannot be determined if a lender is unable to obtain your credit report and report because you have put a freeze on your file. Please visit the Experian Security Freeze Center to get your account unfrozen.

Credit scores are determined on credit reports, and you won’t get a credit report without first having an account recorded in your name. A credit score can’t be determined without at least three months of positive account history, and sometimes even six months, according to several scoring formulas.

You may need to wait a little longer to get a score if you’ve just started using credit in your name.

FAQs

1. Why don’t I have a Credit Score?

Not having a credit score might be due to a lack of information in your credit history or the absence of any records at all. An individual’s credit score is a three-digit number created by sophisticated statistical models utilizing data from the credit report.

Inadequate credit history means the scoring algorithm can’t make an accurate assessment of you and hence can’t give you a score.

Final Words

Experian offers free credit reports and credit scores, so if you’re unsure of your credit standing or just curious about what’s on your file, you can request them there.

Finding out your credit score is a wonderful first step in learning how to raise it, so the sooner you examine it, the better.

Having earned a Bachelor’s degree in Commerce from Ravenshaw University, with a background in Accounting and Finance, Akshita Pattanayak contributes to UniTopTen by writing clear and concise articles based on Finance-Tech. With more than a hundred fin-tech related articles, she hopes to educate people about how banking and payment apps function.